Inherited ira rmd calculator vanguard

But if you own a traditional IRA you must. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death.

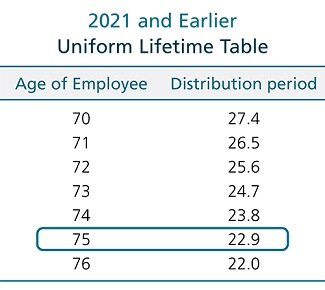

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Calculate the required minimum distribution from an inherited IRA.

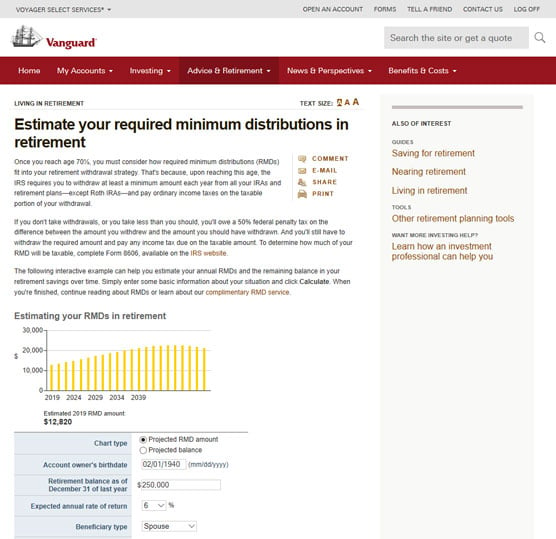

. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. Ad This guide may help you avoid regret from certain financial decisions with 500000.

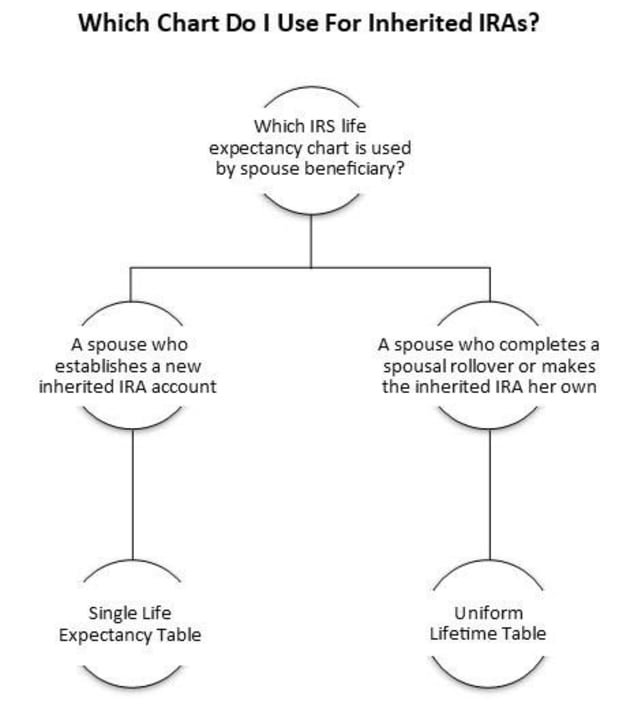

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Normal RMD rules apply based on spouses age. If you inherited an IRA such as a traditional rollover IRA SEP IRA SIMPLE IRA then the rules around RMDs fall into 3 categories.

Ad Use This Calculator to Determine Your Required Minimum Distribution. Find Out What You Need To Know - See for Yourself Now. Therefore if the distribution is from a qualified plan the beneficiary should contact the plan administrator.

Cyberpunk 2077 skill calculator. Calculate the required minimum distribution from an inherited IRA. You can use this calculator to help you see where you stand in relation to your retirement goal and map out.

Spouses non-spouses and entities such as trusts estates. Calculate your earnings and more. For more information about inherited IRAs select the link to RMD rules for inherited IRAs in the Related Items.

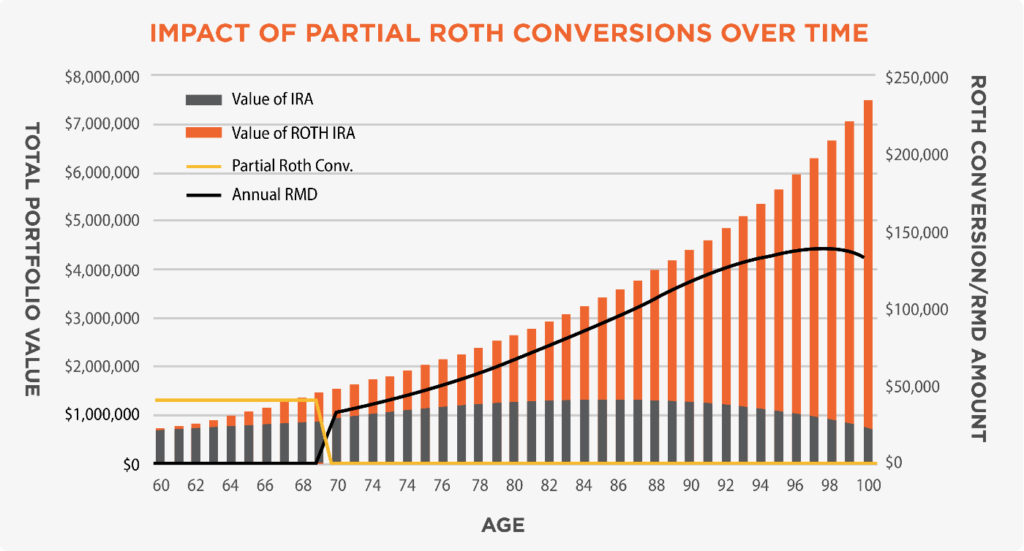

So just when are you required to take your. Run the numbers to find out. Withdrawals at age 72 age 70½ if you attained age 70½ before 2020 older.

If your spouse is more than ten years younger than you please review IRS Publication 590-B to calculate your required minimum distribution. Account balance as of December 31 2021. You should consult a tax advisor to.

The 10-year rule applies regardless of whether the participant dies before on or after the required beginning date RBDthe age at which they had to begin RMDs. If youre RMD age Vanguard will automatically calculate the RMD amount each year for your tax-deferred IRAs and Individual 401ks held at Vanguard. Your life expectancy factor is taken from the IRS.

Distribute using Table I. Vanguards RMD Service doesnt accommodate accounts that are being distributed according to the five-year rule. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

Inherited ira rmd calculator vanguard Sabtu 10 September 2022 Edit. The IRS requires that most owners of IRAs withdraw part of their tax-deferred savings each year starting at age 72 age 70½ if you attained age 70½ before 2020 or after inheriting any IRA. These amounts are often called required minimum distributions RMDs.

RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. RMD amounts depend on various factors such as the decedents age at death the year of death the type of. If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required.

If youve elected or are required to use the five-year rule for your. Inherited IRA Roth IRA Inherited IRA Rules. We researched it for you.

Determine beneficiarys age at year-end following year of owners. If you want to simply take your. Roth IRAs are exempt from RMDs.

Or spouse may take life expectancy payments based on his or her age. Download 13 Retirement Investment Blunders to Avoid from Fisher Investments. This calculator has been updated for the.

If you own a Roth IRA theres no mandatory withdrawal at any age. How is my RMD calculated. Ad All You Need To Know About Inherited IRA RMD.

Early withdrawals are subject to a 10 penalty. Spouse may become account owner. Your retirement is on the horizon but how far away.

For IRA distributions see Publication 590-B Distribution from Individual Retirement Arrangements IRAs or this chart of required minimum distributions to help calculate the required minimum distributions.

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

What To Do If You Miss Your Rmd Deadline Smartasset

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Inherited Iras Rmd Rules For Ira Beneficiaries Vanguard

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

The New Year Will Bring New Life Expectancy Tables Ascensus

Required Minimum Distributions Rmds Youtube

Rmd Taxes Required Minimum Distributions Form 5329

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Inherited Ira Rmd Calculator Powered By Ss Amp C

Irs Wants To Change The Inherited Ira Distribution Rules

Where Are Those New Rmd Tables For 2022

Inherited Ira Rmd Calculator Td Ameritrade

How To Take Money Out Of Your Ira Dummies

Should I Use Dividends To Fund Rmds

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition